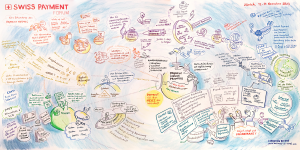

partners Swiss Payment Forum 2023

How to become a Partner

There are so many good reasons why you should consider to partner with the Swiss Payment Forum, read here 5 good reasons. If you too want to become a Partner please get in touch with us now.

Industry

ACI Worldwide is a global leader in mission-critical, real-time payments software. Our proven, secure and scalable software solutions enable leading corporations, fintechs and financial disruptors to process and manage digital payments, power omni-commerce payments, present and process bill payments, and manage fraud and risk. We combine our global footprint with a local presence to drive the real-time digital transformation of payments and commerce.

Erfahren Sie mehr im Who is Who.

Capco, a Wipro company, is a global technology and management consultancy specializing in driving digital transformation in the financial services industry. With a growing client portfolio comprising of over 100 global organizations, Capco operates at the intersection of business and technology by combining innovative thinking with unrivalled industry knowledge to deliver end-to-end data-driven solutions and fast-track digital initiatives for banking and payments, capital markets, wealth and asset management, insurance, and the energy sector. Capco’s cutting-edge ingenuity is brought to life through its Innovation Labs and award-winning Be Yourself At Work culture and diverse talent.

Learn more in the Who is Who

CORE is an IT think tank based in Berlin, Dubai, London and Zurich. As a consultancy with valuable implementation expertise, CORE facilitates the management of complex IT transformations of companies and market participants for whom IT contributes significantly to their business success. With its range of services, CORE addresses large parts of the IT value chain - starting with the analysis of market developments, the design of the (IT) strategy and the definition and management of implementation projects, to the implementation of digital solutions and operations. CORE provides interdisciplinary expert teams devising complex technology strategies together with our clients. These teams combine management consulting expertise with specialized technology and industry-specific knowledge. Besides its technology focus, CORE is specialized in retail and corporate banking as well as insurance, media, public sector and health care.

Learn more in the Who is Who

INFORM GmbH is a global company in advanced optimization software systems and a leader in providing intelligent, customer-centric fraud prevention and AML compliance solutions. With RiskShield we offer a multi-channel platform that detects and manages suspicious activities, minimizing losses and optimizing efficiencies using advanced analytics, machine learning and intuitive rule management controls. RiskShield provides a robust solution with proven fraud detection results that are reliable, fast and responsive. More than 1000 companies worldwide benefit from using advanced optimization software systems by INFORM in industries such as financial services, insurance, telecommunication, health care, transport logistics, airport resource management and production planning. INFORM employs over 900 staff from more than 30 countries.

Learn more in the Who is Who

Mastercard is a global technology company in the payments industry. Our mission is to connect and power an inclusive, digital economy that benefits everyone, everywhere by making transactions safe, simple, smart and accessible. Using secure data and networks, partnerships and passion, our innovations and solutions help individuals, financial institutions, governments and businesses realize their greatest potential. With connections across more than 210 countries and territories, we are building a sustainable world that unlocks priceless possibilities for all.

For 27 years Netcetera has been serving its customers worldwide with best-in-class digital payment solutions. Growing with the business, we are internationally present in 19 cities, with over 850 dedicated employees supporting our customers 24/7. Our award-winning, innovative product portfolio interconnects the whole digital payment ecosystem. We successfully serve 200K+ merchants with acquiring services and protect nearly 100+ million cards at more than 800 banks and issuers with 3DS issuing service.

Learn more in the Who is Who

PostFinance is one of the leading Swiss financial institutions and, as the market leader in payment transactions, ensures a smooth flow of money every day. Whether it's paying, saving, investing, making provisions or financing - PostFinance meets its customers at eye level, speaks their language and offers them understandable products at attractive conditions. This makes it the ideal partner for anyone who wants money to be easy to handle and manages their finances independently. PostFinance employs around 4000 people throughout Switzerland.

Learn more in the Who is Who

Temenos AG (SIX: TEMN) is the world leader in banking software. More than 3,000 banks worldwide, including 41 of the top 50 banks, rely on Temenos to process both daily transactions and customer interactions for more than 500 million banking customers. Temenos offers Cloud-native, Cloud-agnostic and AI-driven front office software for core banking, payments and funds administration, enabling banks to deliver seamless, omnichannel customer experiences and achieve operational excellence. Temenos software has been shown to enable best-performing customers to achieve a cost-to-revenue ratio of 26.8%, corresponding to half the industry average, with a return on capital of 29%, which is three times the industry average. These customers invest 51% of their IT budget in growth and innovation over maintenance, which is twice the industry average, demonstrating that banks' IT investment adds tangible value to their business.

Thede Consulting provides support in the development of future payment solutions. On a European level, we consult decision makers on strategy, concept development and implementation in Financial and Mobility Services, Retail and Loyalty in order to develop business models for seamless, multichannel payment processes. Our core competency is the application of new technologies, e.g. Connected Car, Wearables or Voice Services, as well as the evaluation of valuable data insights for customer retention.

Learn more in the Who is Who

Make convenient and secure payments with TWINT using your smartphone: pay at the cash register in supermarkets, in online shops, when shopping at farm shops, on public transport, when parking or transferring money to your friends. With over five million active users and over 160 employees, TWINT is the leading payment app in Switzerland. TWINT AG belongs to Switzerland’s biggest banks: BCV (Banque Cantonale Vaudoise), Credit Suisse, PostFinance, Raiffeisen, UBS, Zürcher Kantonalbank as well as SIX and Worldline.

Learn more in the Who is Who

For 37 years, van den Berg FS GmbH has been developing innovative payment solutions. With expertise in instant payments, individual and bulk payments, SEPA Card Clearing, SWIFT and EBICS connectivity, van den Berg has established itself in the market as a reliable payments specialist.

Decades of experience and extensive know-how support banks and companies in the efficient handling of payment transactions and related processes. The company's own payment transaction system vdb/PPM can be operated either in-house (on-premise) or completely in its data centers (Payments-as-a-Service).

The solutions of van den Berg are used by about 100 customers, more than 60 of them use the services in the certified data center.

van den Berg has an extensive network, effective partnerships and is proactively shaping the future of payments in working groups.

Learn more in the Who is Who

Visa Inc. (NYSE: V) is the world’s leader in digital payments. Our mission is to connect the world through the most innovative, reliable and secure payment network - enabling individuals, businesses and economies to thrive. Our advanced global processing network, VisaNet, provides secure and reliable payments around the world, and is capable of handling more than 65,000 transaction messages a second. The company’s relentless focus on innovation is a catalyst for the rapid growth of connected commerce on any device, and a driving force behind the dream of a cashless future for everyone, everywhere. As the world moves from analog to digital, Visa is applying our brand, products, people, network and scale to reshape the future of commerce.

Learn more in the Who is Who

Worldline [Euronext: WLN] helps businesses of all shapes and sizes to accelerate their growth journey – quickly, simply, and securely. With advanced payments technology, local expertise and solutions customised for hundreds of markets and industries, Worldline powers the growth of over one million businesses around the world.

Learn more in the Who is Who

The ZHAW School of Management and Law (SML) is one of Switzerland’s leading business schools. Our internationally acclaimed BSc and MSc programs as well as our range of continuing education programs are scientifically grounded, interdisciplinary, and practically oriented. As part of a university of applied sciences, we are devoted to the applicability of theoretical knowledge. Our research and consulting activities are theoretically sound and have practical value, focusing on immediate, efficient feasibility. Our main principle “Building Competence. Crossing Borders.” reflects our commitment to quality degree programs and further education, as well as a global mindset.

Network Partners 2023

Netzwoche is the most widely read, cross-media Swiss B2B publication for business IT and, with Best of Swiss Web, also the home base of the Swiss Internet industry. Netzwoche's independent technology editorial team is the largest of its kind in Switzerland and provides cutting-edge, in-depth reporting on ICT and its impact on business, politics and society. In addition, Netzwoche delves into topics from vertical markets, such as the financial industry, in separate magazine specials.

For example, in the Netzwoche special «Fintech & Insurtech - Digitalization in Banks and Insurance Companies» the editorial team describes and analyzes the technological side of the finance and insurance industry and offers innovative companies from the fintech environment a journalistic platform. All Netzmedien publications are aimed at business decision-makers in organizations in dedicated industries, especially CIOs, CEOs, division and department heads, and business and IT consultants.

www.netzwoche.ch

Media partners 2023

Moneycab, THE news platform for decision makers since 2001. Free of charge, up-to-date, relevant. This is where CEOs, entrepreneurs and founders get information every day. Interviews, digitalization, startups, sustainability, finance or IT: Always be up to date on all channels (web, smartphone, newsletter).

Payments Cards & Mobile is built on three pillars of: Publishing, Research and Consulting. For 28 years we have been supporting the payments industry with our award-winning insight and analysis. We offer our clients services ranging from content creation through reports, white papers and blogs through to distribution via our own platforms, supported by a strong social media presence and paid for media like The Economist and The Financial Times. Payments Cards and Mobile magazine covering Cards, Issuing& Acquiring, Regulation, Mobile Payments, Contactless, e-Commerce and POS is published 6 times a year with supplements.