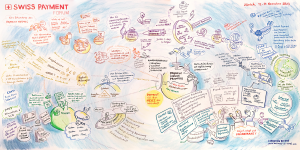

Swiss Payment Forum - November 18 and 19, 2024 in ZuricH

We will start to create the agenda in spring 2024 and are happy to receive your suggestion for a presentation.

If you are interested in becoming a partner of the Swiss Payment Forum, contact Nicole von Mulert.

To stay up to date, subscribe to our Newsletter.

THIS WAS THE AGENDA OF 2023

Conference Day 1 - November 13

08:40

How the Rise of PayTech is Reshaping the Payments Landscape

The EY Global Paytech report was developed through in-depth analysis of the PayTech landscape and from dialogue with global industry leaders. The seven forces are regarded as having significant influence over today’s payments landscape are: open banking, real-time payments, cross-border payments, BNPL, digital wallets and super apps, embedded payments and CBDCs and digital currencies.

+ How the seven forces identified in EY’s PayTech report are changing the industry

+ How the regulators, networks, banks, PSPs and merchants responding to the changing environment

+ How will the future of payments evolve as innovation continues to drive change

Alla Gancz Payments Consulting Leader, Ernst & Young LLP

09:20

Instant Payments as Standard – Optional Becomes Mandatory

+ The current status of the upcoming legal regulation in the EU

+ High accessibility as an opportunity for various use cases

+ Best Practice: How banks can prepare for Instant Payments

Lars Goerke van den Berg

Watch video message

10:00

PostFinance Rediscovers Commerce

+ Developments in commerce

+ New Value Propositions

+ Invisible Payments

+ PostFinance Pay

David Kauer and Bernhard Lachenmeier PostFinance

11:10

Payments – Between Innovation and Security

Santosh Ritter Country Manager, Visa Switzerland and Liechtenstein

Maike Hornung Crypto Business Lead, Visa Europe

11:50

Metaverse & Crypto Payments as a Door Opener for the Future

+ Global transactions: Metaverse & Crypto Payments revolutionise international commerce

+ Financial democracy: Access to financial services for all thanks to Metaverse & Crypto Payments

+ Creativity and Markets: The Metaverse enables the creation, trading and monetisation of digital content and products

Sascha Münger Head Competence Center Crypto Related Products & Metaverse, Worldline

12:30

New Technologies Fueling New Use Cases: The Digitalisation of Customer Relationships and the Role of Payment Transactions

+ Challenges and opportunities in the digitalisation of customer relationships

+ (Generative) AI concretely experienced in payments: from Trusted Authentication to Fraud Management

Jacqueline Good-Ziltener Senior Business Development Consultant, Worldline

14:10

How to Prepare for the new European Legislative Landscape?

“Discovering Europe’s Instant Payments Opportunity”

+ Growth, statistics and trends for Instant Payments analysis from the world

+ A look at recent regulations and rulebooks as enabling factor for growth and success

+ Successful use cases for Instant Payments from around the world

Daniele Astarita ACI Worldwide

14:50

Mastercard: Innovations for a Changing World – Solutions for the Financial Industry

Dr. Daniela Massaro Country Managerin Mastercard Switzerland and Liechtenstein

16:00

Instant Payment. Instant Risk!

With Instant Payment, a payment is irretrievably made within milliseconds. This is a service that the market and customers expect these days.

With the obligation to introduce Instant Payments and migrate payment transactions to real-time, financial service providers now also have to rethink their risk assessment.

Learn how other financial service providers in the EU have been technically mastering this challenge for many years and remain competitive.

Patrick Juffern Business Development Manager, INFORM

16:40

It takes a village to raise a payment and an ecosystem to innovate

Learnings from the world of instant, ISO20022, cloud, Fintech, and AI.

Mick Fennell Business Line Director, Payments, temenos

17:20

KEYNOTE

How Artificial Intelligence will Revolutionise the World of Work and Payment Forever

+ How AI will change all areas of working life

+ How repetitive tasks will be completely taken over by AI

+ Opportunities & challenges for payment and other industries

18:05

Apéro riche

Following the official programme, Vereon invites all participants and speakers to an apéro riche. Take advantage of this opportunity to make and strengthen valuable contacts in a pleasant atmosphere.

Conference day 2 - November 14

08:40

Open Finance, Embedded Finance – New Chances Ahead. Will We Master Them?

+ The Federal Council is exerting pressure: Open Finance must go faster

+ More and more third-party providers want to integrate financial services into their customer journey: Embedded Finance, a huge growth market

+ What opportunities and challenges do we face?

+ What are our competitors doing abroad? What can we learn from this?

Rino Borini Scarossa

09:20

Stablecoins as Drivers for New/Innovative Business Models - Success Examples from the Bitcoin Lightning Network

+ Current developments in Switzerland: Focus on stablecoins, CBDCs, and crypto payments

+ The benefits of Bitcoin Lightning and the potentials arising from Taproot Assets and RGB

+ Examples from the fields of digital media, mobility, and the creator economy

Gregor von Bergen Head of Payments and digital Assets Switzerland, Capco

10:00

Europe's New Independence - Payment Innovations by Regulation

Initiatives extend to the horizon – a new wave of regulations for the European payment market is on its way. Digital Euro, EPI, eID, PSD3 are terms that are supposed to shape the payment market of the future. Yet multinational players abroad are setting the tone in Europe.

In a joint discussion with experts from the Swiss payment market, we dare to take a holistic look at new payment methods in Europe, as well as the effects on the Swiss market.

Andre Standke Thede Consulting

11:10

The Payments Trifecta: Classical Payment Means, Instant Payments, and CBDCs – Who will Actually Move the Needle and Reshape the Payment Landscape, or Will it Be AI Racing for Impact?

+ Where are we in comparison to global developments

+ What actually makes a difference from merchant end customer perspective

+ Which impact will AI have on the payment value chain

Fabian Meyer CORE

11:50

User-Centricity: How TWINT Creates Added Value in Payments

+ Enhancing payment through customer orientation

+ Mobile payments as simplification and reduction of bureaucracy

+ Innovation and user-centric design

Adrian Reto Plattner Chief Sales Officer und Thomas Graf Chief Product Officer, TWINT

Watch video message

12:30

Evolution of In-Car Payments

+ Why we are convinced that in-car payments will become an everyday part of our lives

+ How Mercedes pay turned the car into a payment device

+ What makes native in-car payments convenient and secure?

Isabell Katzenbach Mercedes pay

Watch video message

14:00

Banking of the Future: Via Chat Supported by Generative AI

Kurt Schmid Managing Director Digital Banking, Netcetera

14:10

Sustainable Finance: Biodiversity Risks and Opportunities for Financial Companies

Angela McClellan Director Sustainable Finance, PwC

Centi - Stablecoins and the Future of Payment

The most compelling Stablecoin use case at the same Convenience as Web2 Payments

+ Micropayments Capabilities

+ Disintermediating Payments

+ Transparency in Payment Services

Bernhard Müller General Manager / Chairman of the Board, Centi AG